Starter-home hunting? Here’s how to find an affordable one in a challenging market.

Smart choices can help homebuyers in this spring’s tight housing market.

Springtime means warmer temps, blooming flowers—and real estate season. But the market is different from year to year, and spring 2018 is a uniquely challenging one for buyers, especially those looking for starter homes. This is due to several factors: low inventory, higher prices, and rising interest rates.

“The spring market so far this year is crazy busy!” says Kelly Deschamp, an Illinois real estate agent. So what’s your strategy going to be for buying a home this spring? Here’s what you need to know to decide.

Why? Two words: mortgage rates. To take out a mortgage loan in the 1980s, you’d likely pay up to 16 percent in interest—compare that with today’s mortgage rates of around 4.5 percent. For a $200,000 loan, at 4.5 percent interest, you’d pay $1,013 a month (before taxes, insurance, and other fees), but with 16 percent interest, you’d pay $2,690.

Plus, you can find out if a neighborhood is right for you with the Trulia’s new What Locals Say feature. It reveals what neighborhoods are really like, powered by the people who know them best—the locals who live there.

“The spring market so far this year is crazy busy!” says Kelly Deschamp, an Illinois real estate agent. So what’s your strategy going to be for buying a home this spring? Here’s what you need to know to decide.

The price of starter homes is going up the most.

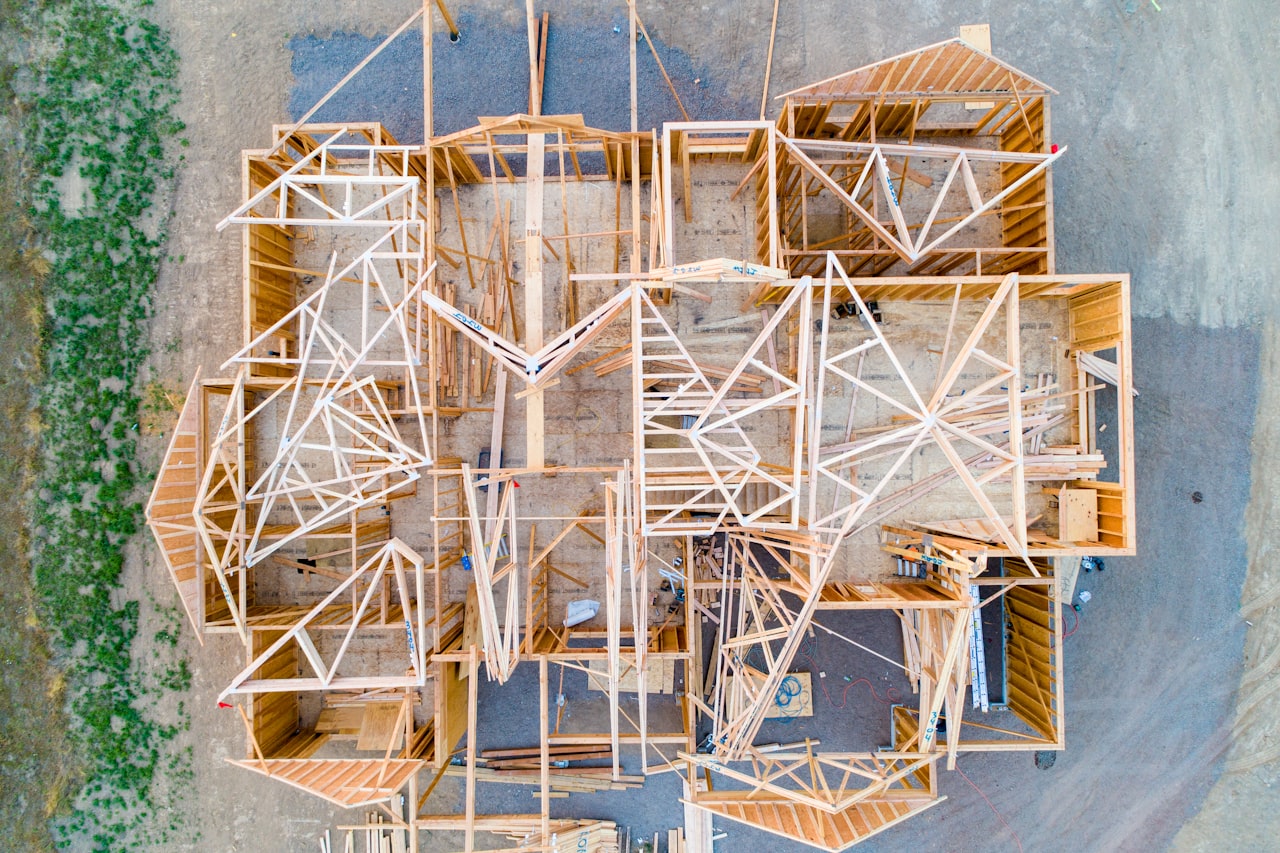

If you’re looking for a starter home this spring, adjust your expectations. With high demand and plenty of competition, prices are rising for starter homes to the tune of 9.6 percent more this spring than last year. Trade-up and premium homes are also more expensive this year—7.5 percent and 5.2 percent more, respectively. If you’re looking for a starter home, consider older or smaller options. Even better, look for a fixer-upper. There are 8.3 percent more fixer-upper starter homes than there were six years ago. That’s good news for anyone willing to put a little elbow grease into their investment.Affordability is on the rise.

Don’t get too bummed about rising prices. Compared to historical housing costs, homes today are actually more affordable than they were in past decades.Why? Two words: mortgage rates. To take out a mortgage loan in the 1980s, you’d likely pay up to 16 percent in interest—compare that with today’s mortgage rates of around 4.5 percent. For a $200,000 loan, at 4.5 percent interest, you’d pay $1,013 a month (before taxes, insurance, and other fees), but with 16 percent interest, you’d pay $2,690.

Finding the right neighborhood matters.

Trulia research found that homeownership is dropping in some neighborhoods and remaining steady in others, even within the same city. Many home buyers prefer neighborhoods full of homeowners, so figuring out the character of an area is essential. Here’s a tip: Hot spots for homeownership share one attribute—increased household incomes. Research neighborhood demographics to pinpoint median incomes and homeownership rates.Plus, you can find out if a neighborhood is right for you with the Trulia’s new What Locals Say feature. It reveals what neighborhoods are really like, powered by the people who know them best—the locals who live there.

Spring 2018 Homebuyer Tips

Arrange your financing.

If you wait until after you’ve found a home to start the mortgage pre-approval process, you might lose the home in this market to someone who already has their financing ducks in a row. “You must get your loan squared away and be ready to close in 15 to 21 days, max,” says mortgage adviser Jason Fox.

Act fast.

To be successful and not make a rash decision, be as prepared as possible before you start looking by knowing the type of home and neighborhood you desire.

Put down a decent amount of earnest money.

The more earnest money you contribute, the more serious you look to the seller. “So on a $400,000 purchase, be ready to put up $7,500 to $10,000,” says Fox.

Be prepared for bidding wars.

In hot markets, buyers should be prepared for bidding wars. Fortunately, bidding wars aren’t always just about money. A shorter closing, willingness to rent the house back to the seller, a super-quick inspection period, and offer letters can help make a lower offer the best offer.